Our Services

Assisting families who have loved ones with intellectual & developmental disabilities plan for their future.

We integrate our financial planning, wealth management, and special needs understanding to simplify life's complexities for your family.

About Oak Wealth Advisors

Our families are like yours. Every member of our team has a personal connection to the disability community, giving us a genuine understanding of the joys and challenges families face.

Meet Our Team All of Oak Wealth Advisors’ Senior Consultants are proud to be members of the Academy of Special Needs Planners

Resources Wherever You Are

We provide you with guidance specific to your state & local resources.

Contact Us Today Other Helpful Resources

The future can be uncertain, Let us help you navigate it.

Top 10 Special Needs Planning Tip #1: Connect with Families

Transcript

Hi everyone, my name is Aaron Osterberg and I will be kicking off our new monthly series where we share a tip from our top 10 special needs planning tips.

Tip number 1: Connect with other families facing similar challenges, both locally and nationally. Building a support network can make a huge difference. Look for organizations and nonprofits, join social media groups, and participate in community events. These connections can provide valuable insights and support.

Stay tuned for tip #2 coming next month. If you want to learn more, feel free to contact us – we’re here to help! Thank you.

Latest Podcast

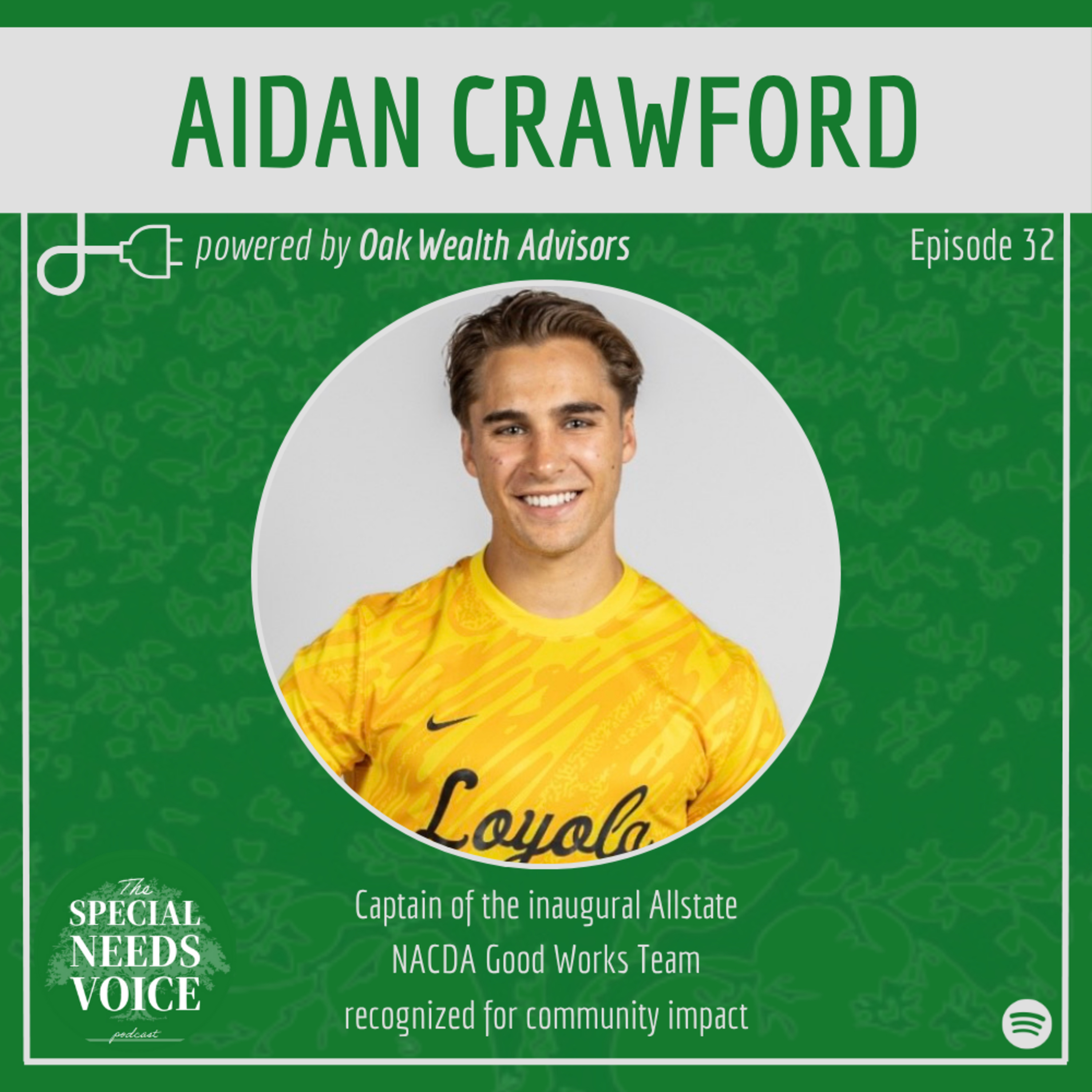

Aidan Crawford | The Special Needs Voice Podcast

Oct 13 •

29 min

30 sec

0:00 / 29:30